Questions:

Are you worried about a beneficiary possibly losing part of their inheritance because of a divorce or a lawsuit? Perhaps you should be because of the high rate of divorce; and because every time someone gets behind the wheel of a vehicle there’s a potential that person could be involved in a multi-million-dollar lawsuit and be found at fault.

Are you worried that your children might lose their job have to file bankruptcy, or get in an accident and have to file bankruptcy, and lose part or all of their inheritance due to such bankruptcy or catastrophic medical bills?

Perhaps you have a child, grandchild, or another beneficiary who you’re worried might squander or waste their inheritance after your death?

Maybe you have a beneficiary who suffers from a substance abuse problem or gambling addiction, a mental illness, a history of making poor spending decisions or unwise investment decisions?

Maybe you have a beneficiary who always seems to be in debt?

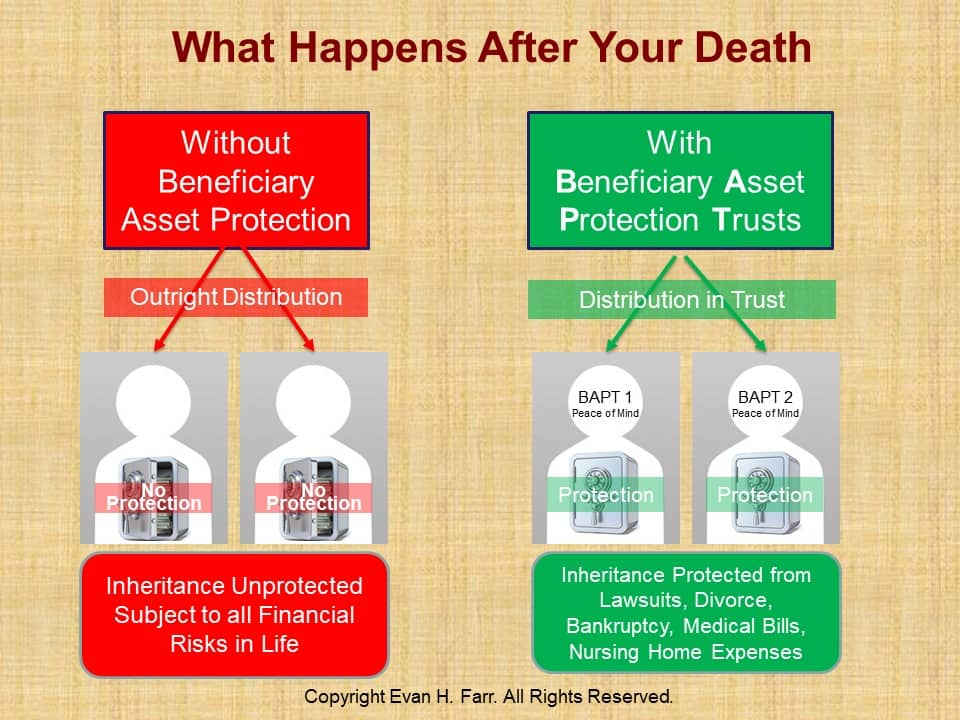

If you have any of the above concerns, you’re not alone, and you should keep reading. But first, here’s a simple diagram showing what happens after death with and without Beneficiary Asset Protection.

Please note that a Beneficiary Asset Protection Trust is known by many other names, including a Spendthrift Trust, a Discretionary Trust, an Inheritance Trust, and a Dynasty Trust. What you call it makes no difference in the protection it provides.

- The beneficiary can have direct control of the assets as trustee of his or her own sub-trust, but the assets are protected from divorce, lawsuits, bankruptcy, and medical bills. The beneficiary can purchase assets in his or her name as trustee of the sub-trust. This can include primary homes, second homes, rental property, vacation property, land, vehicles, etc. — anything that has a title can be titled in the name of the sub-trust and protected inside the sub-trust.

- If you don’t trust the beneficiary to act as the trustee, then you can name a different trustee who can make direct payments to landlords, mortgage lenders, schools, doctors, hospitals, etc. Or the trustee could make regular payments to the beneficiary, similar to an allowance.

Do You Have Concerns about a Beneficiary Asset Protection Trust / Spendthrift Trust / Dynasty Trust / Inheritance Trust?

Many people have some or all of the concerns mentioned at the beginning of this article. If you share any of these concerns, the Beneficiary Asset Protection Trust / Spendthrift Trust may be your best option. Talk to a qualified Virginia estate planning attorney, Maryland estate planning attorney, or DC estate planning attorney about this and other trust solutions.