- Before 1978, employers reported your earnings every three months and we called credits “quarters of coverage,” or QCs. Back then, you got a QC or credit if you earned at least $50 in a three-month calendar quarter.

- In 1978, employers started reporting your earnings just once a year. Credits are now based on your total wages and self-employment income during the year, no matter when you did the actual work. You might work all year to earn four credits, or you might earn enough for all four in a much shorter length of time.

- The amount of earnings it takes to earn a credit has changed since 1978. In the year 2021, you must earn $1,470 in covered earnings to get one Social Security or Medicare work credit and $5,880 to get the maximum four credits for the year. You can check out the Social Security website —www.ssa.gov/benefits/retirement/planner/credits.html — to determine how much you will need to earn in any given year in covered earnings to get one Social Security or Medicare work credit and how much you will need to earn to get the maximum four credits per year.

- If you were born in 1929 or later, you need 40 credits (10 years of work).

- People born before 1929 need fewer than 40 credits (39 credits if born in 1928; 38 credits if born in 1927; etc.)

Spousal Benefits

- The higher-earning spouse files for benefits at his FRA but immediately files a notice to suspend benefits.

- The lower-earning spouse elects to receive spousal benefits.

- The higher-earning spouse continues to accrue higher payments for whatever point he elects to begin receiving benefits.

Disability Benefits

- Before age 24–You may qualify if you have six credits earned in the three-year period ending when your disability starts.

- Age 24 to 31–You may qualify if you have credit for working half the time between age 21 and the time you become disabled. For example, if you become disabled at age 27, you would need credit for three years of work (12 credits) out of the past six years (between ages 21 and 27).

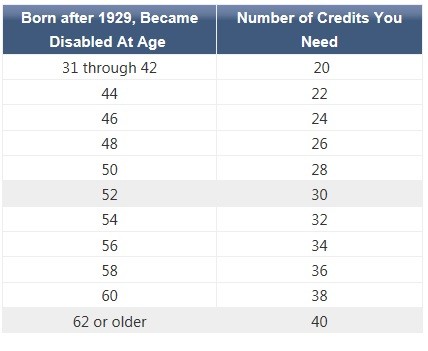

- Age 31 or older–In general, you need to have the number of work credits shown in the chart below.

Note:

You may only claim one type of Social Security benefit. If you choose to accept the disability Social Security plan, you may not receive Social Security retirement benefits and vice-versa.

Different rules apply for farm laborers, government employees, military, nonprofit employees, and household workers.

You can find additional information about disability benefits in SSA’s Disability Planner.

Note:

You may only claim one type of Social Security benefit. If you choose to accept the disability Social Security plan, you may not receive Social Security retirement benefits and vice-versa.

Different rules apply for farm laborers, government employees, military, nonprofit employees, and household workers.

You can find additional information about disability benefits in SSA’s Disability Planner. - You can start your disability claim immediately. There is no need to wait for an appointment;

- You can apply from the convenience of your home, or on any computer; and

- You can avoid trips to a Social Security office, saving you time and money.

- Call 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday from7 a.m. to 7 p.m.; or

- Contact your local Social Security office.

Retirement Benefits for Widows and Widowers

Retirement Benefits for Divorcees

- are age 62 or older;

- were married for at least 10 years;

- have been divorced for at least two years; • ex-spouse is entitled to Social Security retirement or disability benefits; • benefit that you are entitled to receive based on your own work is less than the benefit you would receive based on your ex-spouse’s work; • aren’t currently married to another person (You can collect on a deceased ex-spouse’s record if your remarriage occurred after you reached age 60.)