I’m a Certified Elder Law Attorney practicing in Virginia, and I’ve developed two different Medicaid Transfer Calculators, both of which I use in my own practice, that I also make available to my fellow elder law attorneys nationwide who do Medicaid Asset Protection Planning.

The two calculators are the Transfer and Cure Calculator and the Transfer with Annuity or Loan Calculator.

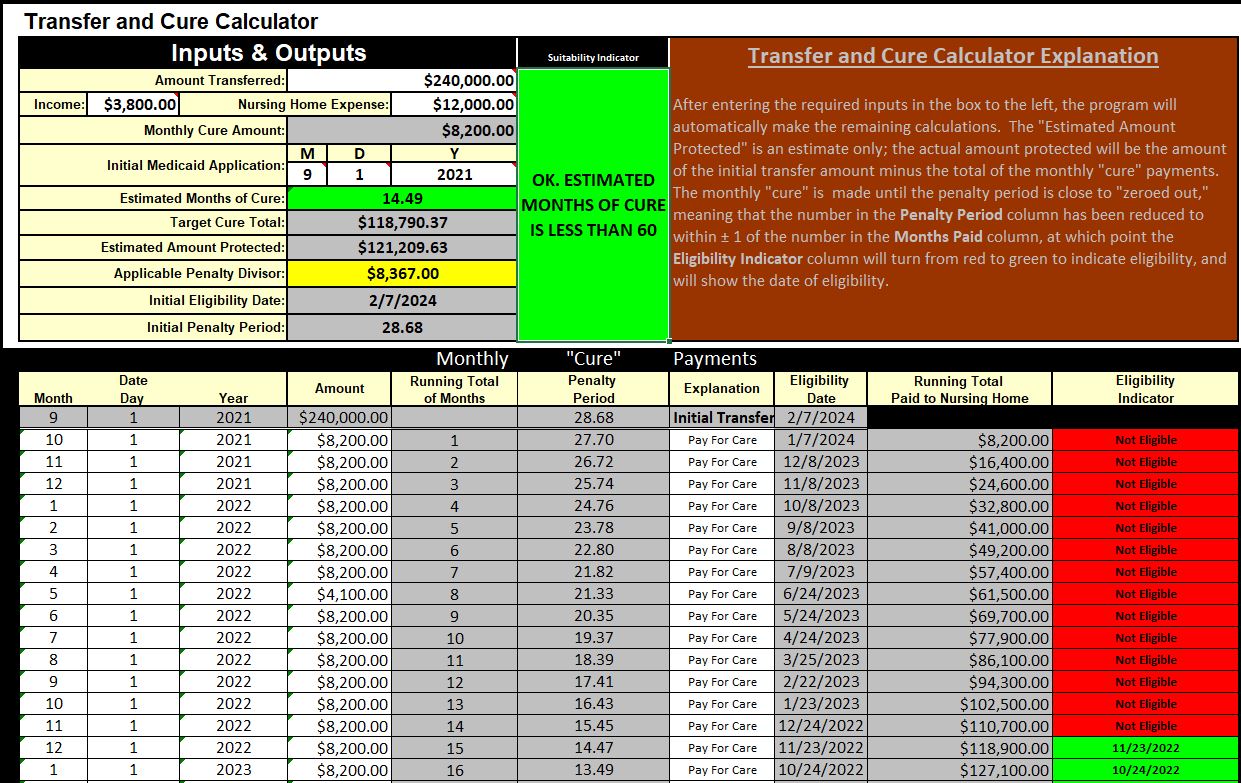

The main problem with all Transfer and Cure strategies (also called Reverse Half-Loaf strategies) is that clients, as well as many attorneys, have a difficult time understanding how the strategy works. I spent over a hundred hours developing this program, which clearly shows (in a way you and your clients can both understand), the gradually declining penalty period as the transferee makes the partial cure each month. Additionally, I include my Client Calculator Module that allows clients to keep track of the gradually reducing penalty period as they make the partial cure each month.

Below are screenshots from the two different programs. As you’ll see, both programs perform all of the calculations automatically with entry of just a few required inputs – Date of Transfer, Amount of Transfer, Monthly Cost of Care, and Monthly Income.

The Transfer and Cure Calculator calculates the initial penalty period and shows how the penalty period is reduced each month as the money is returned, either by the transferee using the gifted money to pay the nursing home each month or by the transferee returning money to the nursing home resident each month (who in turn pays it to the nursing home in the same month).

The Transfer and Annuitize Calculator calculates the penalty period and calculates the Gift Amount (i.e., the amount protected) and the Annuity Amount (to pay for care during the penalty period).

I created these programs from scratch to meet the needs of my practice and my clients. All you need to use either or both of the Calculators is Excel (either the full version or the free Excel Viewer that you can download from Microsoft).

The annual license fee for either calculator separately is $679, or you can license both Calculators annually for $979.

I’ve sold my Transfer and Cure Calculator to dozens of elder law attorneys across the country, and no one has ever been unhappy with it. However, if you’re not completely happy with my program, you can return it within 30 days for a full refund.

If you have any questions about the Calculators, or if you’re interested in purchasing either or both of these Calculators, please send an email to Renee@FarrLawFirm.com, and we will send you the ordering information for payment by check or credit card.

The screenshot below is of the main program screen of the Transfer and Cure Calculator; the required entries show in white at the top left. All the other data is calculated automatically. There’s even a suitability indicator to show you if this strategy won’t work because the cure/annuity/loan period is longer than 60 months.

The screenshot below is of the Transfer with Annuity or Loan Calculator:

The screenshot below is of the Client Calculator Module, allowing the client to enter the monthly “cure” payments: