Geri and Dale are both 70 years old and in average health. They both have a history of dementia in their families and they are aware that the need for long-term care for one or both of them one day could be a real possibility.

Many people worry about not having enough money in retirement because, similar to Geri and Dale, they fear needing long-term care and not being able to afford it — or having to wipe out their savings in order to pay for it. This is why, since Dale was 50, he has invested money every year and saved the dividends to cover long-term care, just in case.

Twenty years later, he has roughly $145,000 saved, and $300,000 in home equity. It is responsible of Dale to invest and save for long-term care. However, there was one thing that Dale did not consider. The $145,000 (even with the $300,000 in home equity) that is supposed to cover both of their care needs is not nearly enough. Dale’s long-term care strategy will most likely not work for them, and I will explain why.

1. Current cost of care: Today, an average nursing home room in the DC Metro Area costs roughly $120,000- $144,000 a year, and the cost is rising. Therefore, $145,000 will not go far if Dale or Geri needs facility care. And, if they both need long-term care or if one of them needs it for more than a year, the investment and the home equity will not be nearly enough! Here are more shocking statistics:

- 15.2% of people who turn (or turned) 65 between 2015 and 2019 will spend more than $250,000 on long-term care during their lives, according to a 2016 report from the National Association of Insurance Commissioners (NAIC). For two people, that’s more than $500,000!

- Most of us are likely to spend another big bundle on healthcare in retirement. A 65-year-old couple retiring today can expect to spend an average of $280,000 out of pocket on healthcare expenses (not including long-term care, over-the-counter medicines, or most dental care) over the course of their retirement, per Fidelity Investments.

2. Increase in costs: From 2017-2018, costs in all long-term care categories increased above the 2.1% rate of inflation, at an average of 3%, according to projections recently released in Genworth’s 15th annual study. Costs in some care categories (a semi-private room in a nursing home, or in an assisted living facility), increased to 4% and 7%, respectively – two and three times the rate of inflation.

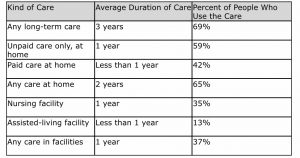

3. 69% will need long-term care: Dale and Geri are right to plan for long-term care, as there’s a good chance they’ll need it. In fact, 69% of those turning 65 this year will need some kind of long-term care during their life, according to longtermcare.gov. This chart is helpful in explaining how much care will be needed and for how long:

Data source: longtermcare.gov

Some people will need long-term care for much longer periods, and some for significantly shorter periods. (A 2017 AARP report estimated that about 14% of people will need long-term care for more than five years.)

4. The number of insurers offering stand-alone long-term care insurance policies has fallen significantly:

According to a report by the NAIC, the number of insurers offering stand-alone long-term care policies (as opposed to hybrid LTC coverage bundled with another product such as a life insurance policy or an annuity) dropped from 125 to 15 between 2000 and 2017. To look at this from the consumer’s perspective, only 70,000 stand-alone policies were sold in 2017, whereas over 750,000 were sold back in 2000.

Currently, an increasing number of life insurance companies are offering an increasing number and type of hybrid policies that provide life insurance (or an annuity) combined with long-term care coverage. These hybrid policies have lowered the cost for consumers dramatically, while lowering risk just as starkly for insurers.

Hybrid LTC insurance policies most often combine permanent life insurance with an accelerated death benefit rider that pays benefits for long-term care or chronic illness. These hybrid policies have been rapidly gaining in popularity because they address some of the shortcomings of traditional LTC insurance policies.

The primary advantages of these hybrid policies are that they offer tax-free reimbursements for qualified long-term care expenses; tax-free death benefits to your heirs if your LTC benefits are not fully used or needed; and a potential return of your premium if you change your mind down the road.

Besides being a Certified Elder Law Attorney, I (Evan Farr) am also an experienced retirement planning advisor and long-term care insurance advisor. Through my financial company, Lifecare Financial Services, I have been helping clients since 2006 purchase and use hybrid LTC insurance policies to assist in paying for long-term care, especially home care and assisted living, before the need for the nursing home level of care arises. Learn more here.

How are you Planning for Your Future Long-term Care Needs?

Americans are living longer, and with longer lives comes the increasing numbers of middle-income seniors who will need long-term care support services. By 2029, approximately 60% of Americans will need a cane, walker, or wheelchair to remain mobile, and 20% will need help with bathing, eating, and dressing (source: U.S. Health and Retirement Study, an ongoing study conducted by the National Institute on Aging and the Social Security Administration.) The significant costs of long-term care can impact retirement plans, savings, and assets, and the level of care one receives. That’s why it’s so important that you speak with an experienced elder law attorney, such as those here at the Farr Law Firm, about long-term care preferences, and to put a long-term care plan in place.

Pre-Need Medicaid Planning and Veterans Benefits Planning for Long-Term Care

Medicaid planning can be started while you are still able to make legal and financial decisions or can be initiated by an adult child acting as agent under a properly-drafted Power of Attorney. In general, pre-need planning for long-term care needs is the best option. The best type of pre-need planning uses a combination of hybrid long-term care coverage to pay for home care and assisted living when needed, and a Living Trust Plus® asset protection trust in order to protect assets in connection with Medicaid so that Medicaid pays for nursing home care if and when needed. For veterans, the Living Trust Plus® also protects assets in connection with a veterans special pension benefit commonly known as aid and attendance, which is designed primarily to pay for home care and assisted living for qualified wartime veterans.

Crisis Medicaid Planning for Long-Term Care

Fortunately for the majority of people who don’t plan in advance, it is never too late to do long-term care planning. Even if your loved one is already in a nursing home or receiving long-term care at home or in an assisted living facility, there are over two dozen different Medicaid asset protection strategies that can be utilized at the time of need, when there’s a long-term care crisis, to protect assets and obtain Medicaid benefits to pay for nursing home care. As a general rule, our firm can protect 100% of the assets of a married couple where one spouse needs nursing home care and the other spouse is still healthy, and we can typically get the nursing home spouse on Medicaid within 2 to 4 months. We can also protect 40% to 100% of the assets of a non-married person who needs nursing home care.

To begin long-term care planning — whether Medicaid Planning and/or Veterans Planning, and/or planning with hybrid insurance coverage, please call us now to make an appointment for an initial consultation:

Elder Law Fairfax: 703-691-1888

Elder Law Fredericksburg: 540-479-1435

Elder Law Rockville: 301-519-8041

Elder Law DC: 202-587-2797

Leave a comment

You must be logged in to post a comment.